Which is better – cash allowance or salary sacrifice?

The choice between a car allowance and salary sacrifice comes down to a balance of flexibility and value. A cash allo...

Anthony K is an Appointed Representative of Fleet Alliance

Request a callback from Anthony K AssociatesDue to our wide range of finance partners we offer consistently competitive leasing offers.

From fleet audit to grade list and vehicle manufacturer choice, we select the appropriate funding products necessary to build you a well priced and optimised fleet.

By taking away the cost and hassle from managing your company vehicles and drivers, Fleet Alliance leaves you and your team free to get on with looking after your customers and growing your business

Our account managers never manage any more than 5 clients at one time. This ensures that the highest levels of customer service are always achieved.

We compare the prices of up to nine finance providers for every quotation. A recent comparison showed that for a 50 vehicle fleet, the savings could be as much as £102,600 over a three year period.

Our account managers never manage any more than 5 clients at one time. This ensures that the highest levels of customer service are always achieved.

A smarter way of selecting vehicles for your fleet which takes into account all the costs associated with running a vehicle, not just the monthly lease payment

Even the best run fleets have room for improvement. We begin every relationship by carrying out a free audit of all aspects of your current fleet.

Our automatic online service reduces your exposure to risk by checking your drivers' licences against DVLA licence data.

Through accident management, we'll reduce your vehicle off-road days, administration and monitoring, leading to a reduction in fleet costs and minimising disruption

Fleet Alliance works with you to understand your objectives and demonstrate how different funding methods could reduce costs whilst supporting your company's business ambitions

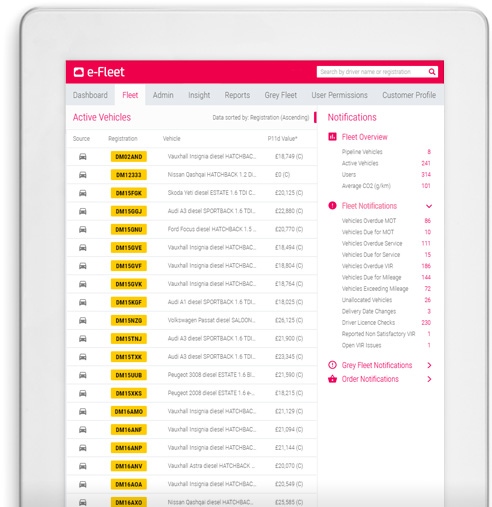

Manage every aspect of your fleet operation in real time, regardless of funder or fleet provider.

24/7 on-the-go support for your drivers helping you concentrate on your core business.

e-Fleet offers greater control of your fleet for less effort whilst delivering significant cost savings and efficiencies. That's a win/win/win

How likely our clients are to recommend us.

Market average: 86% (-7%)

How easy it is to do business with us.

Market average: 87% (-5%)

Our client’s overall satisfaction with Fleet Alliance.

You might know what good fleet management looks like, but have you seen outstanding?

11 Years Running

4 Time Winner

3 Time Winner

Multi-Category Winner

2018 Winner

The choice between a car allowance and salary sacrifice comes down to a balance of flexibility and value. A cash allo...

Demand for car salary sacrifice is growing as an increasing number of companies offer the benefit to their employees. ...

Fleet Alliance Loves is central to who we are, what we do, and how we do business

Learn more

Request a call back